Buying or Selling Your Home

Buy your first home at the best possible price for your local market. With advice and tips from a team of experts, this book will help you.

• explore what's available and where the best values are

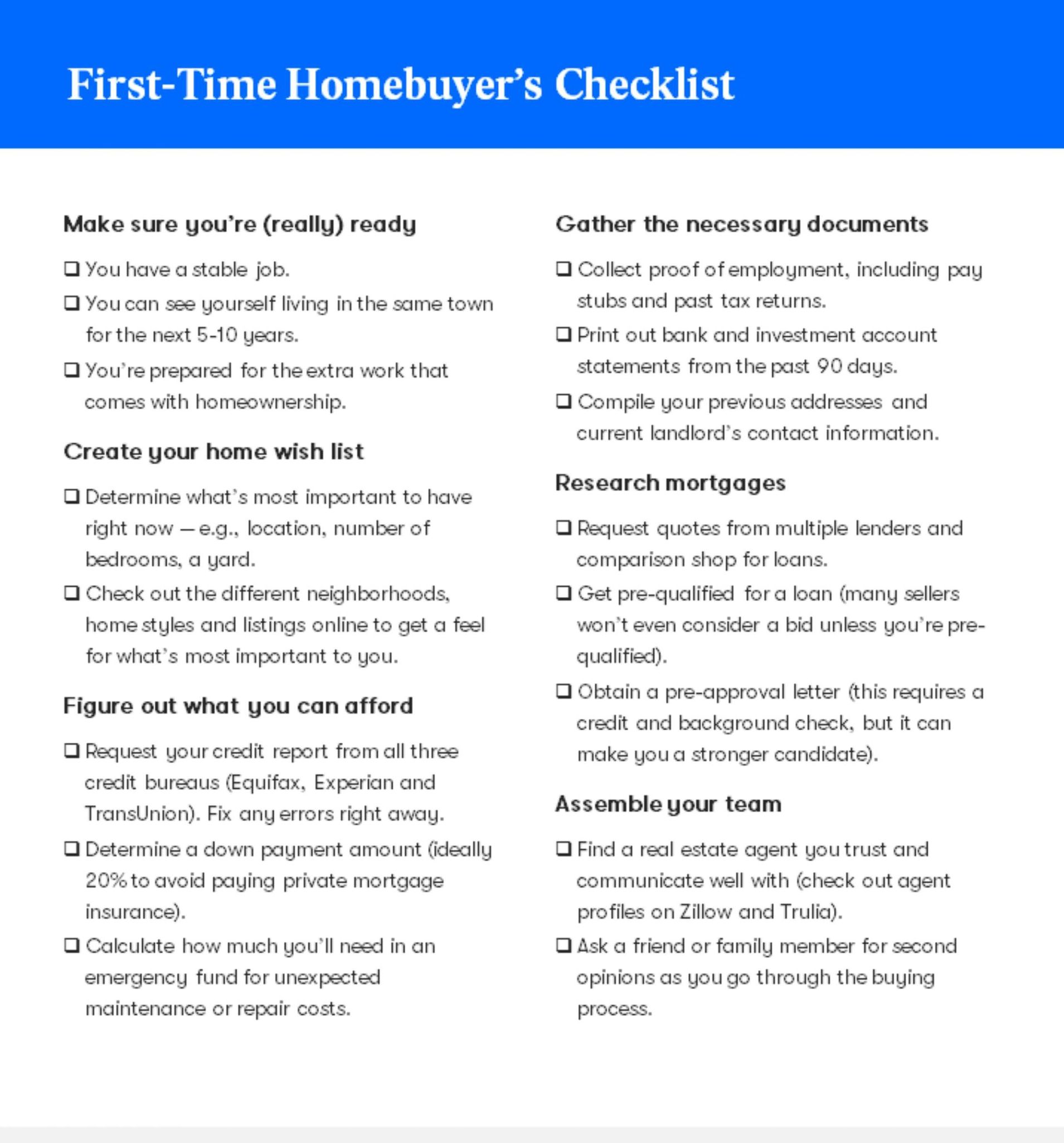

• qualify for and line up financing

• work with the seller to make needed repairs and close the deal

A for-sale-by-owner (FSBO) transaction requires time, know-how and confidence. If you’re not sure that you have all three, enlisting the services of an agent —

a professional who knows the ins and outs of listing and selling homes successfully — pays off.

* Agents Avoid Emotional Sales

"Unraveling the True Worth of Your Home:

The Importance of Professional Property Valuation"

- Finding the accurate market value of your home may raise the question, "What is my home worth?"

- Online services like Zillow use algorithms, guesses, and estimates that may be inaccurate.

- Consulting with a local real estate professional is essential to obtain a reliable home price estimate based on market knowledge.

- Home valuation by a qualified real estate agent provides an estimate of your property's monetary value.

- Obtaining a house value estimate is crucial when selling a home to make informed pricing decisions.

- Knowing the fair market value is key to determining the best sales price.

- Property valuation is also important for tax purposes, as it can lead to potential savings on property taxes.

- Refinancing an existing mortgage may require a house valuation, leading to potential savings on monthly payments.

- A property valuation ensures your home's value aligns with current market conditions-

- Availing a complimentary home value estimate provides confidence in understanding your property's worth.